Navigating Skrill's various fees and limits can be time-consuming and complex. This guide provides a comprehensive overview of Skrill fees and limits for 2024, ensuring you have the latest information. Additionally, discover how linking your Skrill account with eWalletBooster can help you get the best deals and maximise your savings.

One thing to note before you continue reading is that when you progress from a non-VIP to a VIP at Skrill, your fees are drastically reduced and your limits are a lot higher. If you are not yet a VIP member, we can help sort this out for you. Click here to Become a Skrill VIP with eWalletBooster.

Key Takeaways

Up-to-Date Fees and Limits: Comprehensive details on Skrill's fees and limits for 2024.

VIP Benefits: Reduced fees and higher limits for VIP members.

Exclusive eWalletBooster Deals: Enjoy VIP upgrades, fast-track verification, and lifetime cashback.

User-Friendly Navigation: Easily find specific fees and limits for different transaction types.

Enhanced Support: Access priority customer support with VIP status.

Skrill Deposit Fees

There are many methods available to deposit funds into your Skrill account. The fee for most Skrill deposits is 1%, but for some countries and payment methods, a fee of up to 5% may be applied.

Most regular deposits, such as bank transfers and credit/debit cards, incur a fee of 1%. This is in contrast to Neteller deposit fees, where most standard deposits cost 2.5%, except for deposits over $20,000, which are free of charge at Neteller.

Skrill Deposit Limits

Skrill accounts do not have a single hard-and-fast deposit limit; they vary based on several factors. Verified Skrill accounts have large deposit limits, which are usually sufficient for most users' needs. Here’s how to check your deposit limits:

Log in to Skrill: Navigate to the deposit section.

Screenshot of Skrill deposit options (varies by region) Select Your Deposit Method: Choose the method you prefer. For example, select Rapid Transfer.

View Limits: Enter your bank account details, and you will see the minimum and maximum deposit limits.

Screenshot showing Skrill deposit limit

In this example, for verified but non-VIP accounts, the minimum deposit is $1.22, and the maximum deposit is $2,432.64.

Skrill Withdrawal Fees

As with deposit options, there are numerous ways to withdraw your funds. The fee will be determined by the method and your VIP status. Bank withdrawals are free for all VIP levels (Silver, Gold, and Diamond).

For non-VIPs, the withdrawal fees are:

Category | Fee |

Bank Transfer Withdrawal | $6.70 USD |

Credit/Debit Card Withdrawal | 7.5% |

Neteller Withdrawal | 3.49% |

Crypto withdrawal | 2% |

Skrill Withdrawal Limits

Your Skrill withdrawal limits depend on your VIP status and the method you choose to withdraw your funds. To find out your withdrawal limits:

Log into your Skrill account: Click on 'Withdraw.'

Select Your Withdrawal Method: Choose your preferred method.

Confirm Account Details: Proceed to the next page.

View Limits: Your withdrawal limit will be displayed.

Skrill MasterCard Fees and Limits

Skrill has two prepaid card options. The regular physical Skrill Card and the virtual prepaid MasterCard.

Both prepaid MasterCards are available only in the EEA (European Economic Area) and the UK.

Your MasterCard fees and limits will be determined by your VIP level and currency. The comparison tables below show the amounts in euros (€). Those that use non-Euro currency will be charged the current equivalent exchange rate of Euros to their local currency.

You can check your limits in your Skrill account currency by doing the following:

Log into Skrill and select ‘Skrill Card’

Navigate to either your Virtual or Physical card

Click on the currency toggler – in this example it is EUR or USD (the example Skrill account is in USD)

Skrill Mastercard limits example

Physical MasterCard Fees and Limits

Skrill offers physical prepaid MasterCards, available in the EEA and the UK. Fees and limits vary by VIP level.

Category | Non-VIP | Silver | Gold | Diamond |

MasterCard Application Fee | €10 | Free | Free | Free |

Replacement Fee | €10 | Free | Free | Free |

Cash Withdrawal Limit | €900/day | €1,500/day | €3,000/day | €5,000/day |

FX Fee | 3.99% | 2.89% | 2.59% | 1.99% |

ATM Withdraw Fee | 1.75% | Free | Free | Free |

POS Limit | €2,700/day | €3,000/day | €5,000/day | €10,000/day |

Annual Fee | €10 | Free | Free | Free |

Virtual MasterCard Fees and Limits

Category | Fee/Limit |

Order Card | Free |

Replacement Fee | €2.50 EUR |

Annual Service Fee | $10.00 USD |

Max Per Transaction | €2,600 |

Max Purchases per 24 hours | 10 |

Max POS Purchase per 24 hours | €2,600 |

Skrill to Skrill (P2P) Transfers

Skrill to Skrill Transfer Fees

Skrill offers free P2P transfers for VIP and reduced fees of 1.45% for Skrill True members. Non-VIP, non-verified members incur a 2.99% fee.

Category | Fee |

Non-VIP, Non-True Skriller | 2.99% |

Non-VIP, True Skriller | 1.45% |

Silver VIP | Free |

Gold VIP | Free |

Diamond VIP | Free |

Read our detailed guide on Skrill-to-Skrill transfers fees and limits.

Skrill to Neteller Transfers

Skrill to Neteller transfers incur a 3.49% fee, reduced for VIP members.

How to Transfer from Skrill to Neteller

Log into Skrill: Navigate to the withdrawal section.

Select Neteller: Choose Neteller as the withdrawal method.

Enter Details: Input the amount and Neteller account email.

Complete Transfer: Follow the prompts to complete the transfer.

Skrill FX Fees

Skrill charges FX fees based on your VIP level.

Category | Fee |

Non-VIP | 3.99% |

Silver | 2.89% |

Gold | 2.59% |

Diamond | 1.99% |

Skrill Bitcoin Fees

Skrill allows users to buy, sell, and trade cryptocurrencies with varying fees based on transaction amount.

Category | Fee |

Up to €19.99 | €0.99 per transaction |

€20.00 - €99.99 | €1.99 per transaction |

€100+ | 1.50% per transaction |

Skrill Admin Fees

Additional administrative fees may apply for specific scenarios, such as chargebacks or prohibited transactions.

Category | Fee |

Inaccurate Information | Up to €150 |

Chargeback Fee | €25 per chargeback |

Prohibited Transactions | Up to €150 per instance |

Incorrect Transaction Reversal | €25 per reversal |

Skrill Fees vs Other E-Wallet Providers

Deposit Fees

Provider | Bank Transfer | Card Deposit | Other Methods |

AstroPay | Free | Free | N/A |

Skrill | Free | 1-5% | 1-5% |

Neteller | 1% (0% over $20,000) | 1-5% | 1-5% |

Payz.com | 0-10% | 1.69-6% + €0.25 | Varies |

MuchBetter | 0-10% | 0-6% | Varies |

Withdrawal Fees

Provider | Bank Transfer | Card Withdrawal | Other Methods |

AstroPay | Free | 0.5% | N/A |

Skrill | Free (SEPA) | 1.25-2.5% | 3.49% (Neteller) |

Neteller | $10 | 0-3.99% (MC) | 3.49% (Skrill) |

Payz.com | €5.90-10 | 1.99-7.5% (VISA) | 2% (crypto) |

Forex Fees

Provider | FX Fee |

AstroPay | Variable (exchange rate shown) |

Skrill | 3.99% (down to 1.99% for VIP) |

Neteller | 3.99% (down to 1.29% for VIP) |

Payz.com | 2.99% (down to 1.25% for VIP) |

Peer-to-Peer Fees (P2P)

Provider | P2P Fee |

AstroPay | Free (same country) |

Skrill | 2.99% (free for VIP) |

Neteller | 2.99% (free for VIP) |

Payz.com | 1.5% (free for VIP) |

MuchBetter | Free |

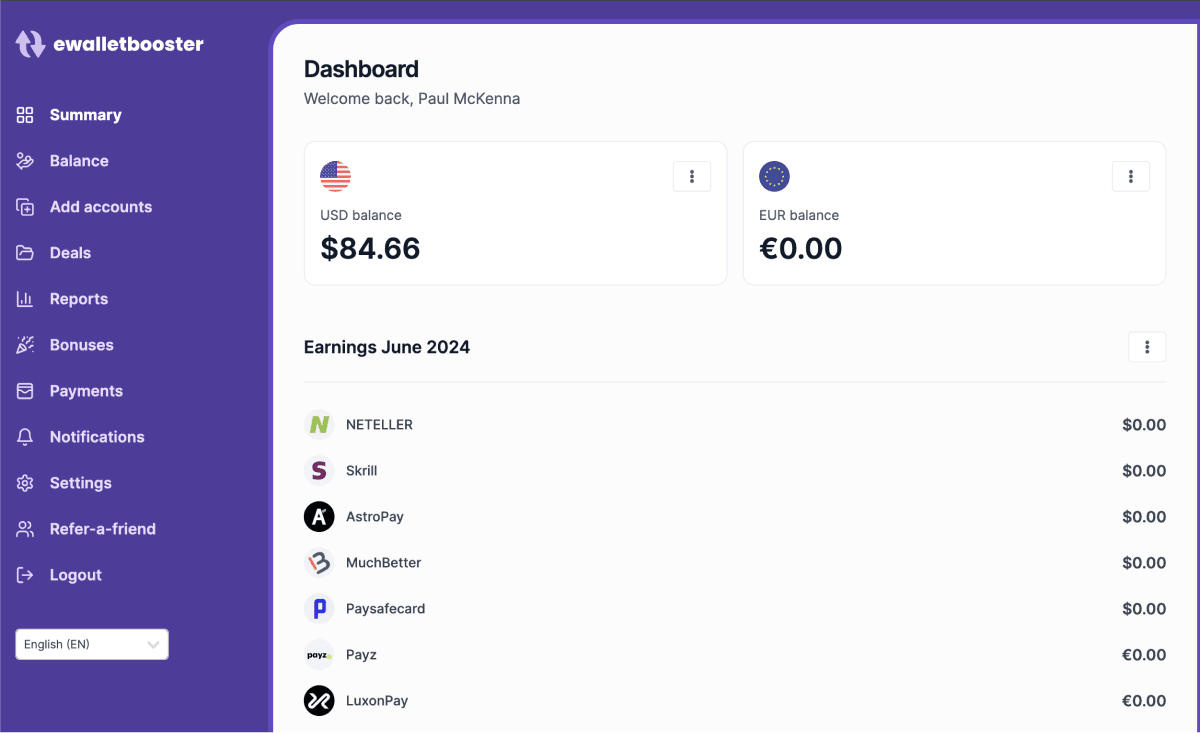

🚀 Exclusive Benefits with eWalletBooster

By linking your Skrill account with eWalletBooster, you access several exclusive benefits designed to enhance your experience and provide additional value. These benefits include:

$30 Bonus from eWalletBooster: Get a $30 bonus when you sign up through eWalletBooster.

Free “Fast Silver VIP” Status: Upgrade to Skrill Fast Silver VIP for free.

Discounted Silver VIP for €5,000: Achieve Silver VIP status for only €5,000 instead of the usual €15,000.

Free Verification: No deposit required for verification, saving you €10.

Priority Verification: Enjoy verification in less than 12 hours.

Free P2P Transfers: Benefit from free peer-to-peer transfers as a Silver VIP.

Discounted FX Fee: Enjoy a 2.89% FX fee (usually 3.99%) as a Silver VIP.

Frequently Asked Questions

What are the Skrill deposit fees?

The fee for most Skrill deposits is 1%, but for some countries and payment methods, a fee of up to 5% may apply. Bank transfers are generally free.

How can I check my Skrill deposit and withdrawal limits?

Log into your Skrill account, select the deposit or withdrawal section, choose your method, and view the displayed limits.

What are the benefits of linking Skrill with eWalletBooster?

You get a $30 bonus, free “Fast Silver VIP” status, discounted Silver VIP for €5,000, free verification, priority verification, free P2P transfers, and a discounted FX fee.

Are there any additional fees with Skrill?

Yes, there are administrative fees for specific scenarios like chargebacks and prohibited transactions. However, most users rarely encounter these fees.

How do Skrill's FX fees compare by VIP level?

FX fees decrease as your VIP level increases, ranging from 3.99% for non-VIP to 1.99% for Diamond VIP members. The FX fees for each VIP level are as follows:

VIP Level | FX Fee |

Non-VIP | 3.99% |

Silver | 2.89% |

Gold | 2.59% |

Diamond | 1.99% |

What are the benefits of the Skrill VIP program?

The Skrill VIP program offers numerous benefits, including reduced fees, higher transaction limits, and enhanced customer support. VIP members also enjoy free P2P transfers, lower FX fees, and exclusive rewards through eWalletBooster.

How do I become a Skrill VIP?

To become a Skrill VIP, you need to meet specific transaction volume requirements. However, by linking your Skrill account with eWalletBooster, you can achieve Silver VIP status with a lower threshold and enjoy additional perks such as free "Fast Silver VIP" status and discounted FX fees.

Get a FREE Fast Silver VIP Upgrade on Your Skrill account with eWalletBooster

Skrill 'Fast Silver' VIP status

Silver for €6k, instead of €15k

Verify for FREE: no deposit required

Fast-track verification

FREE P2P Transfers as Silver VIP

FREE prepaid Mastercard as Silver VIP

Save money with 2.89% forex fee

$30 sign up bonus when you join

Further Reading

If you found this article helpful, you might also like:

- Detailed Skrill Review: Discover Exclusive Benefits and Features

- Unlock Skrill Cashback and VIP Perks with eWalletBooster!

- Skrill Registration Guide: Step-by-Step Process & Exclusive Benefits

- Skrill to Skrill Fees and Limits 2024: How to Save with eWalletBooster

- Skrill Verification Guide 2024: Fast-Track Your Account and Unlock Exclusive Benefits

- Unlock Exclusive Benefits with Skrill's VIP Program Today!