Neteller is a longstanding name in the e-money and e-wallet world, having been around for over two decades. Over the years, Neteller has expanded into various industries, offering users a wide range of services. This review delves into Neteller's offerings, evaluating how they stack up against the competition and what benefits they provide to users.

Key Takeaways

Global Reach: Operates in over 200 countries and supports 26 major currencies.

Secure and Reliable: Regulated by the FCA and employs top-tier encryption and security measures.

Diverse Services: Offers P2P payments, merchant transactions, crypto, and forex services.

Exclusive Benefits: Enhanced perks when joining through eWalletBooster.

User-Friendly Cards: Provides both physical and virtual prepaid MasterCards.

What is Neteller?

Neteller is a British e-money transfer company, now part of the American PaySafe Group. It serves users globally with services spanning P2P payments, merchant transactions, forex, online gaming, and cryptocurrency investments. Neteller is recognized for its fast, secure, and reliable services, processing billions in transactions each year.

Is Neteller Safe?

Yes, Neteller is incredibly safe. As a UK-based company, it is regulated by the Financial Conduct Authority (FCA). Neteller's parent company, PaySafe Group, is listed on the London Stock Exchange's FTSE 250 index, further underscoring its reliability. Neteller also uses advanced security measures, including SSL encryption and Two-Factor Authentication (2FA), to ensure user funds are protected.

Neteller Cards

Net+ Prepaid Mastercard

The Net+ Prepaid Mastercard functions like a standard debit card, allowing you to load funds from your Neteller account and use them for purchases or ATM withdrawals. It offers low fees, especially for VIP users, and supports multiple currencies.

Fees & Limits | Non-VIP | Silver | Gold | Diamond | Exclusive |

Net+ MasterCard Application | $10 | Free | Free | Free | Free |

Replacement Card | $10 | Free | Free | Free | Free |

Cash Withdrawal | €900/day | €900/day | €3,000/day | €3,000/day | €3,000/day |

FX | 3.99% | 3.19% | 2.79% | 2.39% | 1.29% |

ATM Withdrawal | 1.75% | 1.75% | 1.75% | $6 | $6 |

POS Limit | €2,700/day | €2,700/day | €7,000/day | €7,000/day | €7,000/day |

Annual Fee | $10 | Free | Free | Free | Free |

Net+ Virtual Prepaid Mastercard

For online shoppers, the Net+ Virtual Prepaid Mastercard offers a convenient, fee-free option. It can be used immediately upon account creation and is ideal for digital purchases.

Category | Fees |

Card Order Fee | Free |

Cancelled Card Replacement | $2.50 (USD, converted to local equivalent) |

Max Transaction | €2,700 |

Max Purchases in 24 Hours | 10 |

Max POS Purchases in 24 Hours | €2,700 |

Deposits and Withdrawals

Neteller offers a variety of deposit methods, with fees generally around 2.5%, except for large uploads over $20,000, which are fee-free. Withdrawal methods include bank transfers, member wire, merchant sites, and more, with fees varying based on your VIP status.

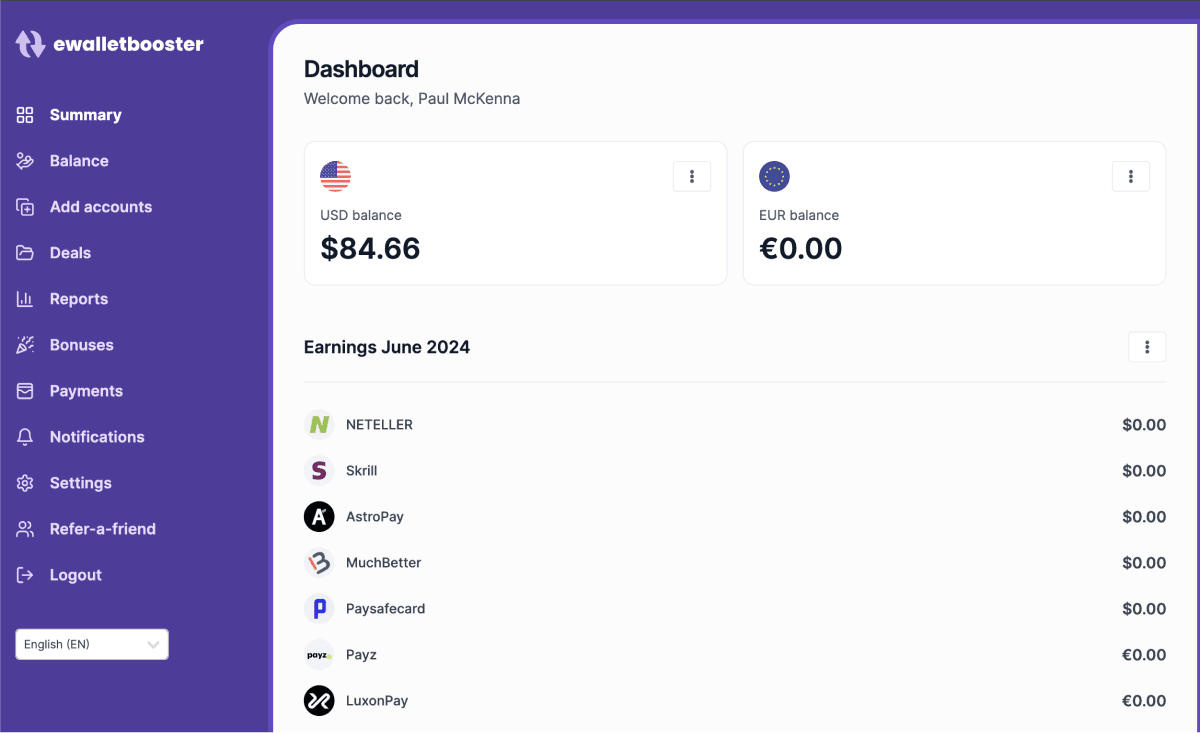

🚀 Exclusive Benefits with eWalletBooster.com

By partnering with eWalletBooster, you can access exclusive benefits with your Neteller account:

Neteller 'Fast Silver' VIP status

Silver for $6k instead of $15k

Free verification: No deposit required

Fast-track verification

Free P2P transfers as Silver VIP

Free prepaid Mastercard as Silver VIP

Save money with 3.19% forex fee

$30 eWalletBooster sign-up bonus

Monthly cashback via eWalletBooster rewards dashboard

Frequently Asked Questions

Is Neteller Safe?

Yes, Neteller is highly secure, employing modern encryption and complying with PCI DSS standards. It is regulated by the FCA, ensuring high trustworthiness.

What services does Neteller offer?

Neteller provides P2P payments, merchant transactions, forex, online gaming, and cryptocurrency services. It also offers prepaid physical and virtual MasterCards.

How do Neteller fees compare to other e-wallets?

Neteller's fees are competitive, often lower than similar services. VIP users benefit from reduced fees, especially for P2P transfers and currency conversions.

How do I get a Neteller prepaid MasterCard?

You can get a Neteller prepaid MasterCard by achieving VIP status. Joining Neteller through eWalletBooster can help you fast-track to Silver VIP status, ensuring your card is delivered at no cost.

What are the benefits of the Neteller VIP programme?

The Neteller VIP programme offers reduced fees, higher transaction limits, free P2P transfers, and free prepaid MasterCards. Higher-tier VIPs enjoy even more benefits like increased support and cashback on transfers.

Conclusion

Neteller stands out in the e-money transfer service market with its robust security, competitive fees, and comprehensive VIP programme. By partnering with eWalletBooster, you can unlock even more benefits, making Neteller an excellent choice for managing your online transactions. Start your journey with Neteller today and take advantage of all the exclusive perks it offers.

Get a FREE Fast Silver VIP Upgrade on Your Neteller account with eWalletBooster

Neteller 'Fast Silver' VIP status

Silver for $6k, instead of $15k

Verify for FREE: no deposit required

Fast-track verification for VIP

FREE P2P Transfers as Silver VIP

FREE prepaid Mastercard as Silver VIP

Save money with 3.19% forex rate

$30 sign up bonus when you join

Further Reading

If you found this article helpful, you might also like:

- Unlock Neteller Cashback and VIP Perks with eWalletBooster!

- Neteller Fees and Limits 2024: Optimize Your Savings with eWalletBooster

- Neteller Registration Guide & How To Get A Joining Bonus

- Neteller to Neteller Transfer Fees and Limits: Maximise Savings with eWalletBooster

- Neteller Verification Guide 2024: Fast-Track Your Account and Unlock Exclusive Benefits

- Neteller VIP Program Explained & Unlock Exclusive Benefits with eWalletBooster