MuchBetter is an excellent e-money transfer service, especially if you want to use your balance with merchants in-person. But before you get spending, it's important to understand your limits and fees—and that's where we come into play.

MuchBetter is an exceptional e-money transfer service once you've registered and verified an account. But that's only the beginning—there's a reward program to understand, and then there are the big ones, fees and limits. Today's focus will be on the latter.

Fees and limits affect your daily use of MuchBetter more than most other factors, so it's crucial that you understand them—read along to get all the details.

Key Takeaways

Increasing Limits: Your account limits increase with frequent use.

Free Services: Many services, including registration and certain transactions, are free.

Transparent Fees: MuchBetter's fee structure is straightforward and competitive.

Exclusive Benefits: eWalletBooster offers additional perks for MuchBetter users.

Simple Verification: Verifying your account unlocks higher limits and more features.

MuchBetter Limits, Explained

MuchBetter splits its limits into three general categories:

General

Card and ATM

Contactless

Each has its own specifics, so it's important to know the difference. General limits cover your account's overall usage and spending thresholds, card and ATM limits are straightforward, and contactless has unique constraints we'll discuss in detail.

General

General fees cover typical spending thresholds but with a unique twist. Most services have strict limits that change with VIP tiers, but MuchBetter measures your account's limits based on usage frequency.

The more you use MuchBetter, the higher your limits will be. Here are the general account limits, which increase with loyalty tiers:

Pre-Verification | Post-Verification |

£150 | £2,500 |

This applies to all your MuchBetter accounts and actions cumulatively over time. Verifying your account is crucial; without verification, you're stuck with a lifetime limit of £150 across all transactions.

Contactless

Some users in higher loyalty tiers will receive a contactless payment FOB. These are limited in usage and application, accepted at specific merchants, and heavily secured.

You are restricted to five transactions with the FOB. After those five transactions, the FOB locks. You can unlock it in your mobile MuchBetter app with your secure PIN and gain five more uses. This prevents unauthorized use if your FOB is lost or stolen.

Card & ATM

Card and ATM limits follow a structure of daily, monthly, and yearly limits.

ATM Limits | MasterCard POS Limits |

Daily Limit | £4,500 |

Monthly Limit | £22,500 |

Yearly Limit | £90,000 |

You can find detailed information on MuchBetter's ATM and MasterCard limits here.

MuchBetter Fees, Explained

MuchBetter's fees are straightforward. Here's a detailed look:

Deposit & Withdraw (Basic Fees)

Many services are free, while others have minimal fees.

Method | Deposit Fee | Withdraw Fee |

Bank Transfer | Free | Free |

Debit Card | Free | Free |

Pay by Bank app | Free | Free |

Crypto | 2% | 2% |

Cash | 7.5% | N/A |

With a MuchBetter Account

After registration and verification, you'll unlock several free services:

Fee Type | MuchBetter Fee |

P2P Send, Receive, Request | Free |

Request a Gift (P2P) | Free |

Merchant Transactions | Free |

Currency Conversion/FX | *0.99% |

*Currency conversion costs vary with all currencies other than GBP, EUR, and USD. Other currencies follow the current market value.

With the MuchBetter MasterCard

One of MuchBetter's popular features is their MasterCard, allowing you to use your balance at various locations.

Fee Type | MuchBetter Fee |

Online Transactions | Free |

In-Person Transactions | Free |

Contactless | Free |

Currency Conversion/FX | *0.99% |

ATM | 0.99% |

*Currency conversion costs vary with all currencies other than GBP, EUR, and USD. Other currencies follow the current market value.

🚀 Exclusive Benefits of eWalletBooster.com Collaboration with MuchBetter

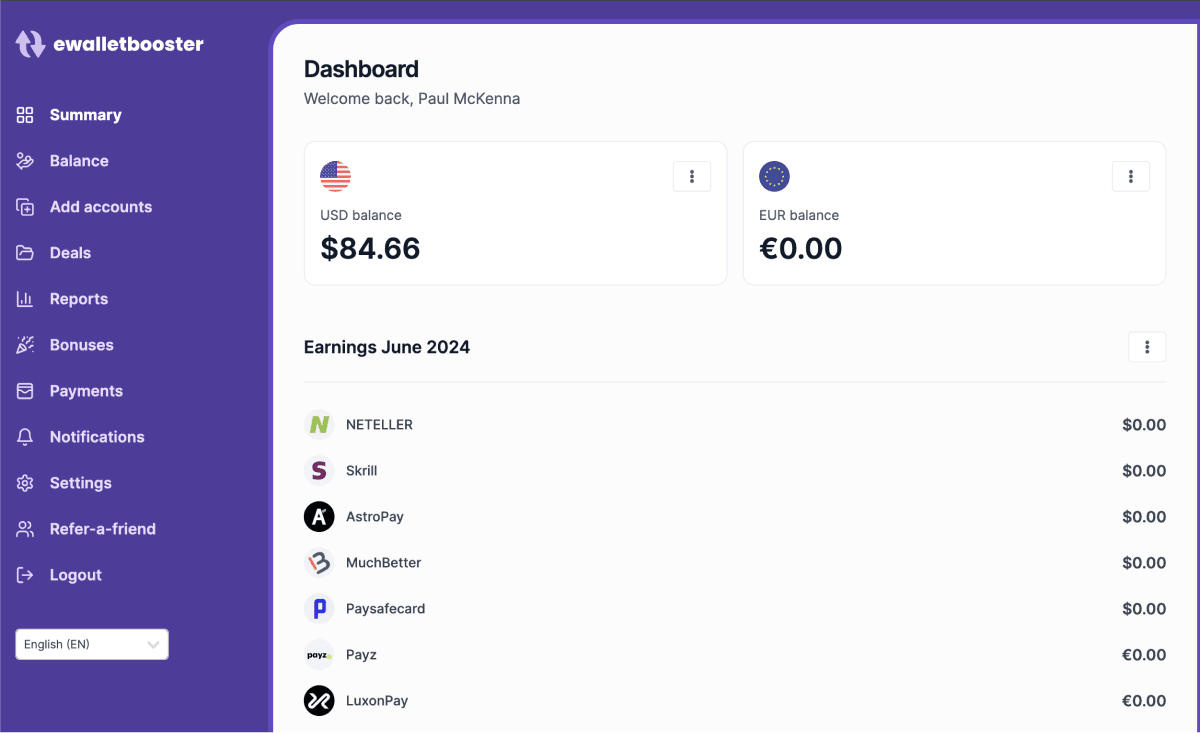

eWalletBooster offers several exclusive benefits for MuchBetter users:

FREE P2P Transfers

Save money with 0.99% FX fee for conversions between USD/EUR/GBP

Earn “MB Coins” on every transaction

Monthly ewalletbooster cashback via ewalletbooster rewards dashboard

MuchBetter Limits Frequently Asked Questions

What is the limit of an unverified MuchBetter account?

Unverified MuchBetter accounts are extremely limited, with a total lifetime spending threshold of only £150 across all transactions. Users cannot withdraw funds until they've verified their account.

How much money can I have on MuchBetter?

Your account balance limit depends on your usage frequency. Higher loyalty tiers result in higher limits. Unverified users have very low limits, while top-tier users can have over £90,000 on their account.

To check your current account maximum, visit your MuchBetter profile's Top Up section.

Why does MuchBetter charge to send money?

MuchBetter's fees for P2P transactions are low compared to similar services. Most European and American currency transactions are fee-free for currency conversion, and P2P transactions to other MuchBetter users are always free.

Why does MuchBetter charge for withdrawal?

Withdrawal fees are standard practice for most e-money services, P2P lenders, and financial institutions. MuchBetter's fees are transparent and reasonable, covering the cost of processing your funds.

Why is MuchBetter so expensive?

MuchBetter isn't expensive compared to its competitors. Their fees are low, transparent, and apply to very few transactions. Their currency conversion and crypto fees are competitive, often lower than many other services.

Fee Type | MuchBetter Fee | Industry Standard |

Registration | £10 | £0-15 |

Verification | Free | £10-25 |

P2P (In-Platform) | Free | £0-4% |

Merchant/POS Transactions | Free | £1.5-3% |

Withdrawal | Varies, generally <£10 | 0-3% |

Start Benefitting From MuchBetter Cashback & FREE P2P transfers today!

Earn monthly cashback on your MuchBetter transactions

Save money with 0.99% FX fee for conversions between USD/EUR/GBP

“MB Coins” on every transaction

FREE P2P Transfers

FREE virtual Mastercard

Further Reading

If you found this article helpful, you might also like: